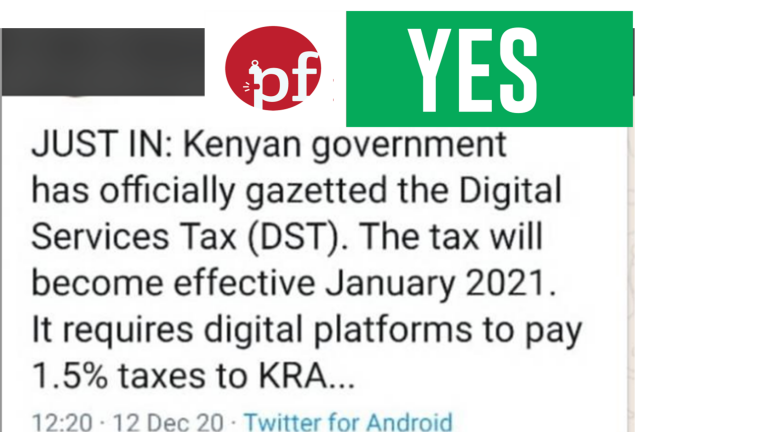

A Facebook post states that the government of Kenya has gazetted the Digital Service Tax.

Background

With Kenya’s debt soaring to over KSh. 6.6 trillion, the government has been having trouble keeping up with payments, especially on high-interest loans from China. Treasury Cabinet Secretary Ukur Yatani told the National Assembly’s Finance and Planning Committee that the country’s debt was Ksh. 7.1 trillion as of early December- about 71.2% of the GDP. This comes as the International Monetary Fund, the World Bank and the civil society raise concern over the rapidly growing national debt.

This has led the government to institute additional taxes to try and meet up the expected income to service the loans. Former Mandera MP Billow Kerow shared a tweet saying that Kenyans are the most overtaxed in Eastern African region. The sentiments had previously been stated by a senior tax partner at Delloite, Fred Omondi in 2016. He went on to say that despite the economy under-performing, taxes were increasing.

Verification

The Digital Service Tax (DST) is a tax that is payable on income derived or accrued in Kenya from services offered through a digital marketplace. The DST was introduced in the Finance Act 2020 which was passed by parliament on June 23 and assented on June 30, 2020.

The Finance Act 2020 states that a tax of 1.5% of gross transactional value will be paid to the government. The tax will be chargeable on income from digital services accrued in or derived from Kenya through a digital marketplace. The Kenya Revenue Authority (KRA) will appoint agents for collection and remittance of the tax.

Communication from KRA further stated that the DST becomes effective from 1st January 2021.

Digital Service Tax (DST) is charged on income derived or accrued in Kenya, from the provision of services through a digital marketplace with effect from 1st January, 2021. #DigitalServiceTax@ntakenya

— Kenya Revenue Authority (@KRACorporate) December 17, 2020

Verdict

Reports that the government of Kenya has gazetted the Digital Services Tax that requires digital platforms operating in Kenya to pay a tax of 1.5% effective January 2020 is TRUE.

Add comment