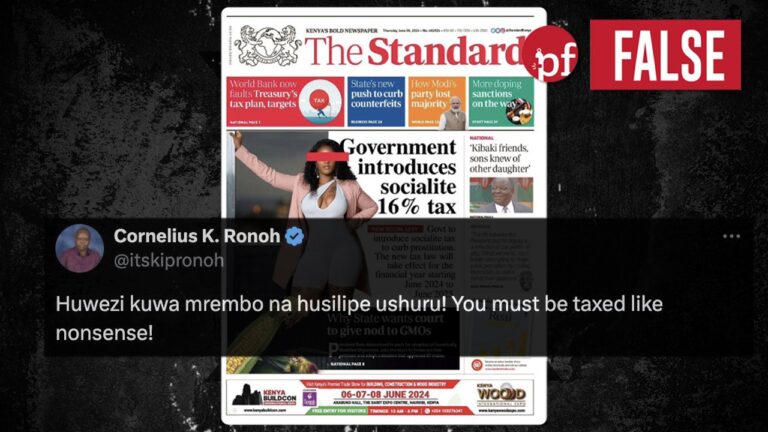

This post with an image of the front page of The Standard newspaper shared on X claims that the Kenyan government is introducing a 16% ‘socialite tax’ with the apparent goal of ‘curbing prostitution’. The image contains the branding of The Standard newspaper, and is dated June 6.

The sub-headline refers to this tax as a ‘new social levy,’ adding that the government is set to introduce this tax to curb prostitution which will take effect for the financial year starting June 2024 to June 2025.

Background

The Finance Bill 2024 tabled in parliament on May 13, 2024, is a proposal to amend various taxes and duties in Kenya. It comes barely a year after the Finance Act of 2023 which was assented to by President William Ruto on June 26, 2023.

Verification

Kenya’s fiscal year begins on 1st July of the current calendar year and ends on 30th June of the next calendar year. Therefore, the sub headline shared by this front-page newspaper stating that the Kenya government plans to implement this said tax starting June 2024 to June 2025 is not accurate.

Additionally, a daily newspaper brief published on June 6, 2024, by the Media Council of Kenya (MCK) and The Standard’s ePaper, proves this newspaper is fabricated. A comparison between these two publications, it is evident that the former, which alleges an introduction of a 16% socialite tax is altered. All the other stories are the same as what was actually in the front page, with the difference being false socialite tax claim on the altered front page rather than a story on a joint drive by President William Ruto and former Prime Minister Raila Odinga to campaign for Odinga’s bid to become the African Union Commission chairperson.

Further, the font used in the altered front page is different from what The Standard actually uses.

Part of the proposed taxes introduced in the Finance Bill 2024 is Motor vehicle tax which shall be payable based on the value of the motor vehicle, engine capacity in cubic centimetres and year of manufacture of the motor vehicle. This amount shall not be less than five thousand shillings and shall not be more than a hundred thousand shillings.

Another tax reform proposed in this bill is an excise duty on excisable services offered in Kenya by a non-resident through a digital platform. According to an analysis by Bowmans, this proposed 20% is a gross turnover earned by the non-resident person. The excise duty applies to telephone and internet data services, fees charged for money transfer services by banks, money transfer agencies, and other financial service providers, betting, lottery, gaming and prize competition, and fees on digital lending.

Additionally, this bill plans to introduce a minimum top-up tax for a resident person if their combined effective tax rate for a year is less than 15%. This tax applies to persons with a permanent establishment in Kenya who are members of a multinational group, and the group has a consolidated turnover of 750 million or more in the consolidated financial statement of the ultimate parent entity in at least two of the four years before the tested income year.

The Finance Bill does not capture an introduction of a 16% socialite tax as alleged by this publication.

Verdict

The claim that the Kenyan government has introduced a 16% socialite tax is FALSE, and the image bearing the headline making this claim is doctored.

Add comment